If you want to collect rent without a headache, it all boils down to one simple idea: set crystal-clear expectations from day one. Your lease agreement is the rulebook for your entire landlord-tenant relationship. Get this right, and you'll sidestep countless disputes and keep things smooth and professional.

Establishing Your Rent Collection Framework

The secret to stress-free rent collection isn't some magic trick—it's just a solid, detailed lease. This isn't just a formality you rush through at signing. It's the legal backbone that protects your investment and prevents a whole lot of future arguments.

The secret to stress-free rent collection isn't some magic trick—it's just a solid, detailed lease. This isn't just a formality you rush through at signing. It's the legal backbone that protects your investment and prevents a whole lot of future arguments.

Think of the lease as your first line of defense. When you spell out every single detail of the payment process, you're building a system that’s easy for tenants to follow and even easier for you to enforce. No more ambiguity, just a clear reference point for everyone.

Essential Lease Clauses for Rent Payment

Your lease needs to be specific. Leave absolutely no room for interpretation. I’ve seen firsthand how vague language creates confusion that can spiral into serious problems. Focus on adding clauses that cover every predictable "what if" scenario.

Here's what you absolutely must include, spelled out in plain English:

- The Exact Due Date: Don't just say "the beginning of the month." State the specific day, like "Rent is due on the 1st day of each calendar month."

- Accepted Payment Methods: List exactly how you'll accept rent. If you don't want checks, say so. For example: "Rent is payable only via ACH transfer through the tenant online portal."

- Your Late Fee Policy: Detail the exact fee, when it kicks in, and how it’s calculated. Make sure this is compliant with your state and local laws, which often have caps on fees and mandatory grace periods.

- Consequences of Non-Payment: Briefly outline the steps you'll take if rent isn't paid, from official notices to initiating eviction proceedings as the law allows.

Key Takeaway: Your lease agreement is the single most powerful tool you have for collecting rent. A fuzzy, generic lease is an invitation for trouble. A specific, legally solid one sets a professional tone from the start.

Crafting Unambiguous Lease Language

The words you choose really matter. Instead of using generic legal templates, write clear, actionable instructions. This proactive step helps manage tenant expectations and shows you mean business.

Here's a great example of a strong late fee clause:

"Rent is due on the 1st of each month. A grace period is provided until 5:00 PM on the 5th of the month. If rent is not received by this time, a late fee of $50 or 5% of the monthly rent, whichever is less, will be immediately assessed. This fee is considered additional rent and is due with the overdue payment."

See how clear that is? It defines the due date, the grace period cutoff, the fee amount, and its legal status. That's the kind of clarity that holds up.

Many of the best property management apps can help you automate these rules, making the whole process smoother for both you and your tenants. Ultimately, building a system around these clear terms is a form of practical workflow automation, a concept that can save you a ton of time and energy.

Choosing the Right Rent Payment Methods

Once your lease lays down the law, the next piece of the puzzle is picking the tech that makes it dead simple for everyone to follow the rules. Honestly, still relying on paper checks or cash in this day and age just adds headaches you don't need—think postal delays, bounced checks, and security risks.

Making the switch to a modern payment method is one of the single best moves you can make to get paid on time, every single month.

The name of the game is reducing friction. When paying rent is as easy as ordering a pizza from their phone, tenants are way more likely to pay you the minute they get the notification. This isn't just about making life easier; it's about running a professional operation and shoring up your cash flow. In fact, landlords who jump on board with online rent collection platforms often see late payments drop by as much as 30%.

Dedicated Online Rent Payment Platforms

If you're treating your rental properties like a real business (which you should be!), then dedicated platforms are the way to go. I'm talking about services built specifically for landlords, like Avail, Zillow Rental Manager, or Landlord Studio. These aren't just payment processors; they're designed to handle the whole collection workflow for you.

What makes them so powerful are the landlord-specific features you just won't find in a standard payment app:

- Automated Late Fees: They can automatically calculate and tack on late fees based on your lease. This alone saves you from awkward conversations and manual math.

- Payment Blocking: This is a huge one. Many let you block partial payments, which is absolutely critical if you're ever in the unfortunate position of starting an eviction.

- Rock-Solid Record Keeping: They automatically generate receipts and keep a clean, exportable payment history for every tenant. Come tax time, this is a lifesaver.

Yes, most of these platforms charge a small fee for transactions (usually a couple of bucks for an ACH transfer), but the time you save and the consistency you gain almost always pay for the service many times over.

Peer-to-Peer Payment Apps

Apps like Zelle, Venmo, and PayPal are everywhere. They’re fast, tenants already have them, and they can feel like an easy solution, especially if you only have one or two doors and a great relationship with your tenants.

But—and this is a big but—they were never built for this. Zelle is quick and free, but it offers zero landlord controls. Venmo and PayPal have business profiles, but using personal accounts for rent can get your account flagged and lacks the protections you need.

A Word of Caution: P2P apps are a minefield for landlords. They can't block partial payments, they don't automate late fees, and their transaction histories might not hold up as proper documentation in a legal dispute. If you go this route, you have to be a meticulous bookkeeper.

Direct Bank Transfers and ACH

Another route is setting up a direct bank transfer or a standing order. An ACH (Automated Clearing House) transfer is a secure, direct bank-to-bank payment. The key difference is control: with a direct debit, you pull the funds, while with a standing order, the tenant pushes the funds to your account on a set schedule.

The downside? Setting these up directly with a bank can be a bit clunky and sometimes comes with fees. You’re also stuck tracking everything manually. There's no dashboard to see who has paid and who hasn't at a glance, which can get messy fast. When you're deciding what works, think about what's easiest for your tenants, too. You can get some good ideas by looking at examples of how tenants can pay their rent.

Comparing Modern Rent Collection Methods

So, which path should you take? It really boils down to how many properties you manage, what your tenants prefer, and how much of this process you want to put on autopilot. This table should help you see the pros and cons side-by-side.

This table compares popular rent payment methods based on fees, speed, security, and landlord/tenant convenience to help you make an informed choice.

MethodTypical FeesTransfer SpeedKey Features for LandlordsBest ForOnline Platforms~$2.50 per ACH; ~3% for credit cards3-5 business daysLate fee automation, partial payment blocking, auto-receipts, payment tracking dashboard.Landlords seeking automation and robust record-keeping for one or more properties.Peer-to-Peer AppsOften free for personal use; ~2-3% for business transactionsInstant to 1-3 daysSimple payment requests and notifications. Very limited landlord-specific features.Landlords with a single property and a high level of trust with their tenant.Direct Bank TransferCan vary by bank1-3 business daysSecure and direct deposit into your account. No automation or tracking features.Landlords who prefer a no-frills, direct banking relationship and don't mind manual tracking.Ultimately, the best method is the one that gets you paid on time with the least amount of drama. For most landlords, the control, automation, and legal protection offered by a dedicated platform make it the clear winner.

Mastering Communication And Rent Reminders

Good communication is what keeps payments flowing in on time. Let's be real—even the best tenants get busy and forget a due date. That's why having a solid system of friendly, professional reminders isn't just a nice-to-have; it's essential for modern landlords.

It's not about being a pest. It’s about being a professional and making it easy for them to pay you.

When a tenant knows to expect a quick reminder a few days before the 1st of the month, it just becomes part of their routine. This one simple habit can turn rent collection from a potential headache into a smooth, predictable transaction for both of you.

Different payment methods have slightly different workflows, but the need for clear communication is the constant.

Whether it's an online portal, a bank transfer, or something else, a good reminder system keeps everyone on the same page.

Whether it's an online portal, a bank transfer, or something else, a good reminder system keeps everyone on the same page.

Crafting Rent Reminder Messages That Actually Work

Your reminders need to hit that sweet spot: polite but firm, and with all the key info. The goal here is to be helpful, not confrontational. You'll quickly find a rhythm and tone that feels right for you and your tenants.

Feel free to adapt these templates for your own use. I've found they work wonders.

1. The "Heads-Up" Nudge (Send 3-5 days before rent is due)

- Subject: Friendly Rent Reminder for [Property Address]

- Body: Hi [Tenant Name], Just a quick heads-up that your rent of $[Amount] is due on [Due Date]. You can pay right through the online portal here: [Link to Portal]. Hope all is well!

2. The Gentle Overdue Notice (Send the day after rent is late)

- Subject: Quick Question About Rent for [Property Address]

- Body: Hi [Tenant Name], Just checking in. Our records show we haven't received your rent payment of $[Amount], which was due yesterday, [Due Date]. Please make the payment as soon as you can via [Link to Portal]. As a heads-up, late fees will kick in per your lease if we don't receive it by [End of Grace Period]. If you've already sent it, please just let us know. Thanks!

These simple messages keep things professional and the lines of communication wide open. For more ideas on effective messaging, check out our guide on recovering the lost art of email reminders.

The Magic of Automated Reminders

Manually sending these emails is a total drag, especially if you manage more than one property. It's tedious and, frankly, easy to forget. This is where automation becomes your best friend.

Forgetting to send reminders can create real cash flow problems. Consistency is everything.

Automating this whole process means every single tenant gets the right message at the right time, every month, without you having to think about it.

My Favorite Productivity Hack: You don't need a huge, complicated property management suite just for this. Sometimes, a simple, focused tool that does one thing perfectly is all you need.

That's where a "hidden gem" like Recurrr comes into the picture. It's not trying to be an all-in-one property management app. Its superpower is sending recurring, automated emails on a schedule you create. You can set up your pre-due date nudge and your gentle overdue notice one time, and Recurrr handles it from there. It's a small productivity hack that's an invisible tool you can use in addition to your other systems.

This approach saves hours of admin work and, in my experience, dramatically cuts down on late payments. It builds an unbreakable habit of consistency that benefits everyone.

Navigating Late Payments with Confidence

Sooner or later, it happens to every landlord. Even with the best tenants and the smoothest system, a rent payment will come in late. It’s an unavoidable part of the business.

How you handle these situations is what really separates the pros from the amateurs. Your response needs to be firm, fair, and most importantly, consistent every single time. A well-defined process takes the emotion out of a stressful situation, turning a potential confrontation into a series of predictable, professional steps. This approach not only backs up the terms of your lease but keeps you compliant with local landlord-tenant laws.

The First 24 Hours: Your Immediate Game Plan

The clock starts ticking the moment rent is officially late—that is, the day after your grace period ends. This is not the time to wait and see. Hesitating sends a signal that your due dates are more like suggestions, which is a precedent you definitely don't want to set.

Your first move is to send a clear, professional communication. This isn't just a reminder; it's the start of your official record and gives the tenant a chance to fix the issue before things escalate.

- Action: Send a formal written notice. For this first step, an email is usually perfect.

- Content: Keep it simple. State the amount due, the original due date, and mention that the late fee has now been applied, referencing the clause in their lease.

- Tone: Business-like and factual. Avoid accusations or emotional language. This is simply a transaction that hasn't been completed.

A quick message is all you need: "Hi [Tenant Name], this is a notice that your rent payment of $[Amount], due on [Date], has not been received. Per your lease agreement, a late fee of $[Fee Amount] has been added to your balance."

This direct approach leaves zero room for confusion and creates a paper trail from day one. It’s a core part of knowing how to collect rent from tenants the right way.

Enforcing Your Late Fee Policy—No Exceptions

A late fee policy is completely useless if you don't enforce it. It can be tempting to waive it "just this once," but making exceptions is a slippery slope that can undermine your authority and even open you up to claims of discrimination. Consistency is your best friend.

Think of the late fee as more than just a penalty. It’s there to compensate you for the extra administrative work and financial headache that a late payment causes.

Your policy must be applied to every tenant, every single time. Waiving a fee for one person but not another destroys your credibility and can seriously weaken your position if you ever end up in court. It's a simple rule of thumb that protects your business.

In the current market, this consistency is more critical than ever. With 39% of tracked markets seeing YoY rent declines, you can't afford to be lenient with your income. The data is clear: automated systems and consistent reminders have been shown to cut down on delinquencies by 25-40%. You can discover more insights about apartment market trends on naahq.org.

When It's Time for a Formal "Pay or Quit" Notice

If your first messages are met with silence and the rent is still missing, it's time to escalate to the next legal step. This usually means issuing a formal "Notice to Pay or Quit" (the exact name can vary by state). This is a legal document that formally tells the tenant they have a set number of days to pay everything they owe or move out.

This is a serious step, and you have to get it right.

- Know Your Local Laws: First, research the specific requirements in your state and city. This includes the notice period (often 3-5 days), what information must be included, and how it has to be delivered.

- Use a Legal Template: Don't just write one up yourself. Find a state-specific template to make sure it contains all the necessary legal language to be valid.

- Serve It Properly: The law is very specific about how this notice must be delivered. Common methods include certified mail, personal delivery, or posting it conspicuously on the tenant's door.

Documenting every single one of these interactions is non-negotiable. Keep copies of all notices, log the dates and times you communicated, and save every email. If this ends up in an eviction proceeding, that file will be your most important piece of evidence. The whole process, from that first friendly reminder to the formal notices, becomes much easier to manage if you have a system. You can learn more about how to send recurring emails to automate those initial reminders, ensuring they go out like clockwork and establish a professional tone from the start.

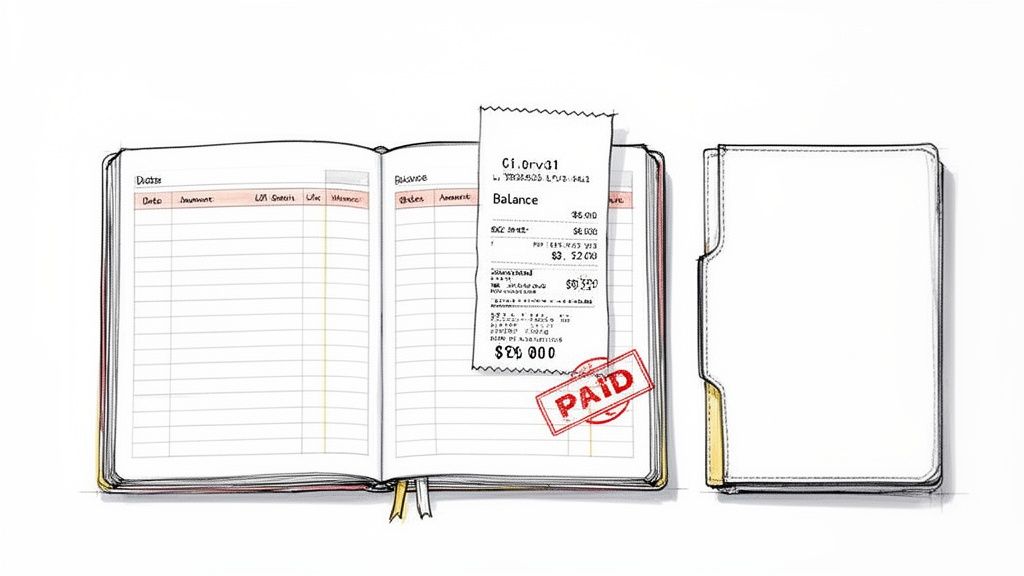

Keeping Meticulous Financial Records

Let's talk about the unsung hero of property management: exceptional record-keeping. This isn't just a "nice-to-have" business habit; it's your primary legal and financial shield. If you ever end up in a dispute or an eviction hearing, your clear, consistent documentation becomes your most powerful evidence.

Let's talk about the unsung hero of property management: exceptional record-keeping. This isn't just a "nice-to-have" business habit; it's your primary legal and financial shield. If you ever end up in a dispute or an eviction hearing, your clear, consistent documentation becomes your most powerful evidence.

And when tax season rolls around? It’s the difference between a smooth filing and a month-long migraine. Maintaining a detailed financial history for each tenancy creates an indisputable source of truth, professionalizing your entire operation.

The Anatomy of a Perfect Rent Receipt

Every single time a tenant pays you, they need a receipt. No exceptions. It doesn't matter if they paid through an online portal or handed you a rare paper check—a receipt is a non-negotiable. Think of it as a formal acknowledgment that protects both of you from any future "he said, she said" arguments.

A proper receipt isn't just a scribble on a piece of paper. It needs to contain specific details to be complete and professional.

Here’s a quick checklist of what every single receipt should include:

- Tenant’s Full Name and Property Address: Pinpoint exactly who paid and for which unit.

- Payment Amount and Date Received: State the exact dollar amount and the day you got the funds.

- Payment Period: Specify the rental period this payment covers (e.g., "Rent for October 2025").

- Payment Method: Note how they paid, whether it was an "ACH Transfer," "Zelle," or "Check #1234."

- Landlord’s Name or Company Name and Signature: Make it official.

This level of detail leaves absolutely no room for confusion. It’s a simple but critical part of maintaining a transparent, professional relationship with your tenants.

Why You Need a Clear and Current Payment Ledger

Going beyond individual receipts, you must maintain a master payment ledger for each tenant. This is the running history of their entire financial relationship with you. A well-kept ledger is gold when you need to quickly check a tenant's payment history, calculate an outstanding balance, or prepare for legal action.

The ledger should be a straightforward table or spreadsheet tracking every financial event for that unit. This consistency is key. Industry benchmarks actually show that landlords with consistent collection practices can improve their outcomes by 20-35%. In a market where pandemic-era rent hikes often masked underlying payment risks, that stability is huge. You can read the full research on rent collection efficiency on rentecdirect.com.

Your ledger needs columns for:

- Date of Payment

- Amount Paid

- Payment Period Covered

- Late Fees Assessed

- Late Fees Paid

- Outstanding Balance

Pro Tip: Update the ledger the same day a payment comes in. Seriously. Letting this slide for even a few days can lead to mistakes and create a backlog of admin work you’ll absolutely dread tackling later.

Using Technology for Flawless Record-Keeping

Look, manually creating receipts and updating spreadsheets works, but it’s slow and leaves the door wide open for human error. This is where technology really shines. Most modern online rent payment platforms handle this entire process for you, automatically.

When a tenant pays through a portal, the system instantly logs the payment, updates the ledger, and generates a digital receipt. It’s then emailed to them and stored securely in your account. That automation ensures every record is accurate, time-stamped, and easy to pull up whenever you need it.

Even if you’re not ready for a full-blown property management suite, you can still streamline things. Some of the most successful landlords I know find that using a focused tool for specific repeating tasks makes a huge difference. If you're looking for ways to automate other landlord duties, our guide on the best recurring task app might give you some ideas. These small productivity hacks free up valuable time you can reinvest elsewhere.

At the end of the day, whether you use a dedicated platform or a simple spreadsheet, the key is consistency. Flawless financial records are the foundation of a well-run, profitable, and legally protected rental business.

Frequently Asked Questions About Rent Collection

Even with the slickest rent collection system, you're going to run into weird situations. It just comes with the territory. Having clear, ready-to-go answers for the common curveballs tenants throw at you is key to handling things professionally and, more importantly, consistently.

Think of this as your playbook for the real-world scenarios that pop up time and time again.

What Should I Do if a Tenant Wants to Pay in Cash?

This is a classic one. While cash might seem easy, it's a huge risk because it leaves no automatic paper trail. You're creating a "he said, she said" situation waiting to happen.

If you find yourself in a bind and have to accept cash, you absolutely must provide a signed, detailed receipt on the spot. I’m talking date, exact amount, property address, and the specific rental period it covers (e.g., "June 2024 Rent"). Don't skimp on the details.

Honestly, the best move is to just say no. Your lease should be your shield here. For all new tenants, make sure your lease agreement explicitly states that cash is not an accepted form of payment. It protects you, and it protects them.

Is It Legal to Refuse a Partial Rent Payment?

This is where things can get tricky, and the answer is a big "it depends" on your local and state laws. In a lot of places, accepting even $1 of a partial payment can completely derail an eviction process if you've already started one.

Before you even think about accepting less than the full amount, you need to check two things: your lease agreement and your local landlord-tenant laws. My strong advice? Get a quick consultation with a lawyer who specializes in this stuff. A rock-solid lease will have a clear policy on whether partial payments are accepted and under what very specific conditions.

Key Insight: Taking a partial payment can be seen by a judge as you agreeing to new payment terms. This can seriously undermine your legal standing if things go south and you end up in court. Know the law before you touch the money.

How Soon Can I Charge a Late Fee?

You can charge a late fee the moment your lease says you can—as long as your lease complies with state law. Many states have mandatory grace periods, usually between 3 to 5 days, before you can legally tack on a fee.

To keep yourself out of hot water, your lease needs to spell out three things with zero ambiguity:

- The rent due date (e.g., the 1st of every month).

- The exact grace period (e.g., "rent is considered late after 5:00 PM on the 5th of the month").

- The specific late fee amount or how it’s calculated.

Always, always double-check that your late fee policy is fully compliant with your city and state regulations before you enforce it.

Can I Use a Tool Like Recurrr for Official Notices?

Here’s a critical distinction: Recurrr is a fantastic little productivity hack for sending those friendly, automated rent reminders that keep tenants on track before they're late. It's your "invisible assistant" for proactive communication.

However, you should never use it for official legal notices, like a "Notice to Pay or Quit." These are formal legal documents with very strict delivery rules set by state law—things like certified mail or personal delivery by a process server. These rules exist to make sure the notice is considered legally binding.

So, use Recurrr for the gentle nudges. But the second things get serious and you need to send a formal notice, switch to the legally required channels.

Let's be real, managing rentals means juggling a ton of small, repetitive tasks. Recurrr is a simple productivity tool designed to help you automate routine communications like rent reminders, freeing you up to focus on what really matters. You set up recurring emails once, and they run on autopilot. It’s all about maintaining professional consistency without the manual grind. See how you can simplify your workflows at Recurrr.com.